Hidden Opportunities in Global Expansion: New Startup Ideas to Thrive Internationally

Learn how AI dominance, strategic hiring, and scalable platforms can drive success in international markets.

What Startups Can Learn from Rippling’s Strategy

Expanding a startup into new markets is a thrilling but challenging journey. The risks of entering unfamiliar territories are high, but so are the rewards for those who navigate global expansion with a strategic approach. Hidden within this process are new startup ideas and opportunities that can help startups not just survive but thrive internationally.

Drawing lessons from Rippling’s internationalization strategy, recent data on startup funding and hiring trends, and insights from expert discussions, here are the key hidden opportunities for startups aiming to expand globally.

Note: The insights presented in this article are a result of an in-depth review of the LinkedIn event discussion, "Startups 2024", and the Stripe-hosted video on internationalization strategies (YouTube link), and our analysis of funding and hiring trends. These resources provided invaluable guidance and community input to identify hidden opportunities.

1. Early Monetization Trends

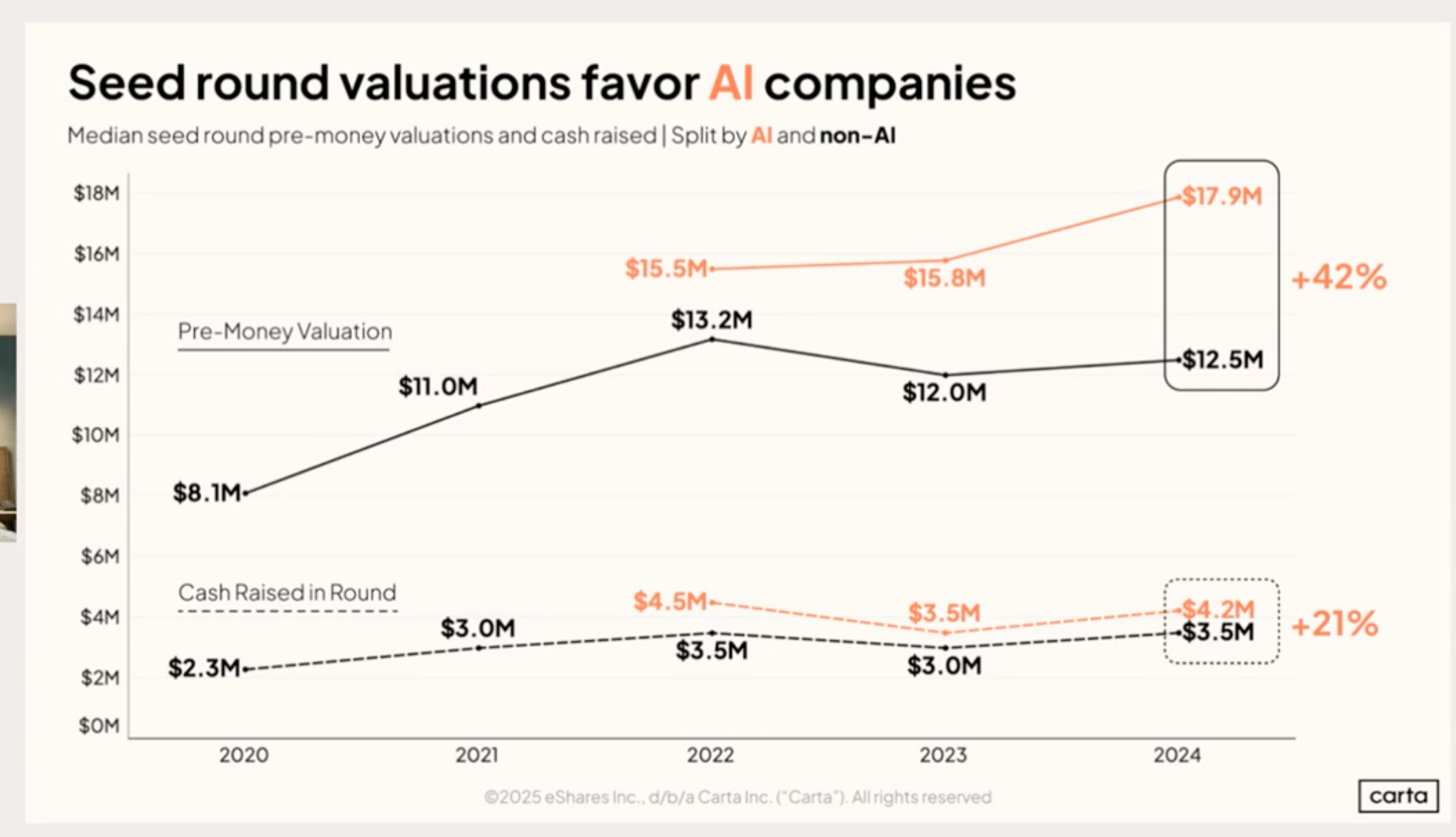

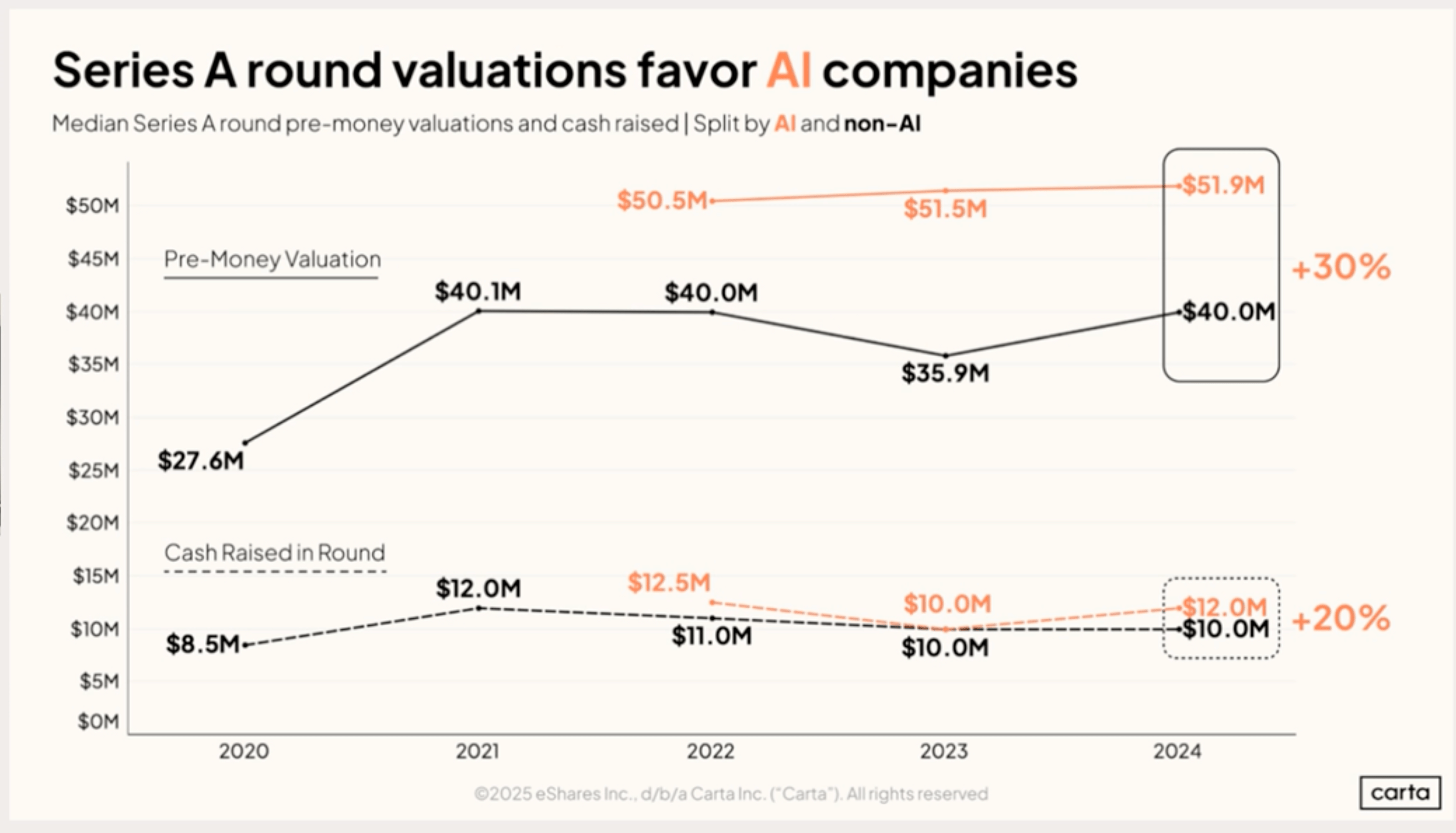

Startups today are monetizing faster than ever before. Data shows that companies founded in 2022 were 60% more likely to generate revenue within their first year compared to those founded in 2019. This aligns with the higher valuations and funding rounds observed for AI companies.

The AI sector's strong performance suggests that focusing on cutting-edge technologies and aligning them with global market needs can accelerate early monetization. Startups that prioritize international expansion into regions with a strong demand for innovation can further amplify this advantage with new startup ideas.

2. Easier Market Entry

The barriers to entering new markets have significantly decreased.

According to a Stripe survey, 86% of startup founders believe it’s easier to expand internationally now than it was five years ago. Improved digital infrastructure and streamlined global platforms make this possible.

However, this aligns with another opportunity with New Startup Ideas: leveraging AI solutions that attract higher investor confidence. The consistent funding dominance of AI companies in both seed (42% higher valuations) and Series A rounds (30% higher valuations) reflects a growing investor preference for sectors that promise scalability and efficiency—traits vital for global expansion.

3. Customer-Driven Expansion

One of the most overlooked opportunities lies in listening to existing customers. Rippling’s global strategy was driven by customer signals, with users requesting services in new regions.

For AI startups, the consistent funding advantages indicate that investors perceive them as having broad and scalable market applications. By analyzing where customers are based and understanding their needs, AI and non-AI startups alike can reduce risks and expand with built-in demand for thier New Startup Ideas.

4. The Second Mover Advantage

In mature markets, startups can learn from existing competitors and build solutions that address unmet needs. This is particularly relevant when targeting underserved sectors or regions.

For example, AI companies that raised higher capital in Series A rounds have the flexibility to invest in localized solutions or complex market challenges. Startups can take inspiration by entering regions where demand is evident but competition is less aggressive.

5. Strategic Workforce Management

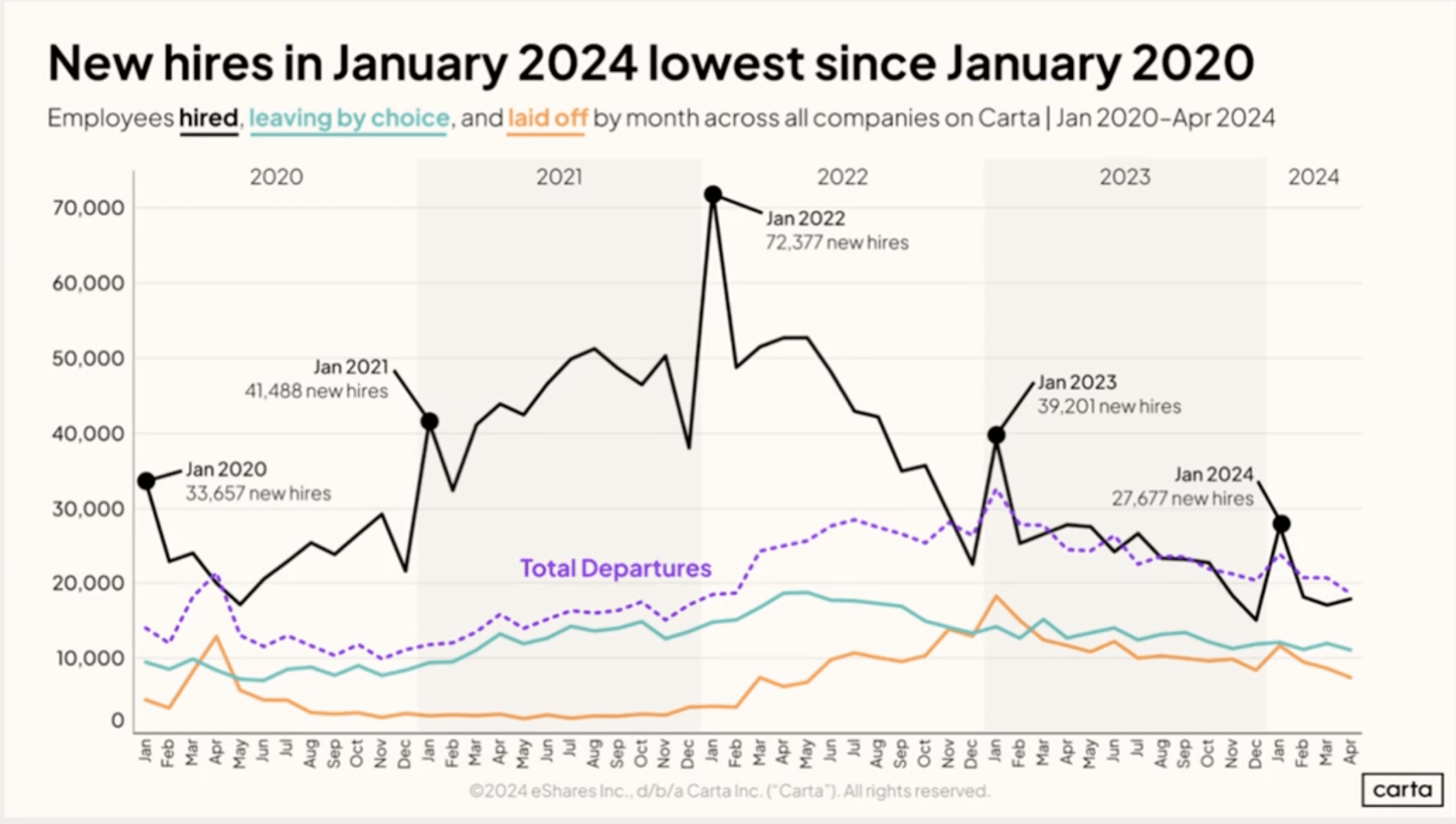

A major challenge of global expansion is managing teams in diverse locations. Data from January 2024 highlights a significant decline in new hires—the lowest since 2020 (27,677 compared to 39,201 in January 2023).

This slowdown reflects market caution, but it also underscores an opportunity for startups and founders with new startup ideas to build lean, remote-first teams while leveraging global talent. Rippling’s remote workforce model and strategic hiring decisions highlight the potential for efficiently scaling operations while maintaining cultural connectivity.

6. Scalability Through Platform Solutions

Startups often make short-term decisions that create technical debt, forcing them to switch platforms as they grow. Investing in scalable, long-term solutions ensures operations can adapt to future growth. The higher funding rounds for AI companies suggest that investors value platforms that can scale globally while addressing complex problems such as compliance and localization. For startups, this means prioritizing platforms that support global ambitions from the outset.

7. Leveraging Economic Trends

The downturn in hiring highlights broader economic caution, but it also opens opportunities. With fewer companies aggressively expanding their workforce, startups entering new markets may find a more accessible talent pool. Additionally, New Startup Ideas can capitalize on market conditions by negotiating favorable terms with local vendors and partners.

Rippling’s ability to establish a strong presence in Europe through deliberate investments reflects the importance of timing and adaptability.

The path to global expansion is paved with opportunities for startups that are willing to think strategically and invest wisely. By leveraging customer insights, embracing complexity, and building scalable platforms, startups can turn challenges into advantages.

These insights, drawn from expert analysis and the broader community—including the LinkedIn event and Stripe-hosted video—highlight the actionable strategies startups need to expand globally when you have New Startup Ideas.

The rising investor preference for AI companies, the shifting dynamics in hiring, and the insights shared by industry leaders underscore the potential for innovation, adaptability, and long-term success.

Global markets are not just destinations—they are growth engines for those bold enough to seize the opportunity with New Startup Ideas.

Startups that integrate innovative technologies, build lean teams, and prioritize long-term scalability will emerge as leaders in the next wave of global expansion.